- October 24, 2021

- Posted by: Adviser Leads

- Categories: Business plans, Marketing Tools, Strategy

A customer journey map for financial advisers is a rare thing. In our experience, very few firms or individuals have this as part of their marketing and even fewer actually know what this is, or why it’s a good idea to have one. So, what is a customer journey map?

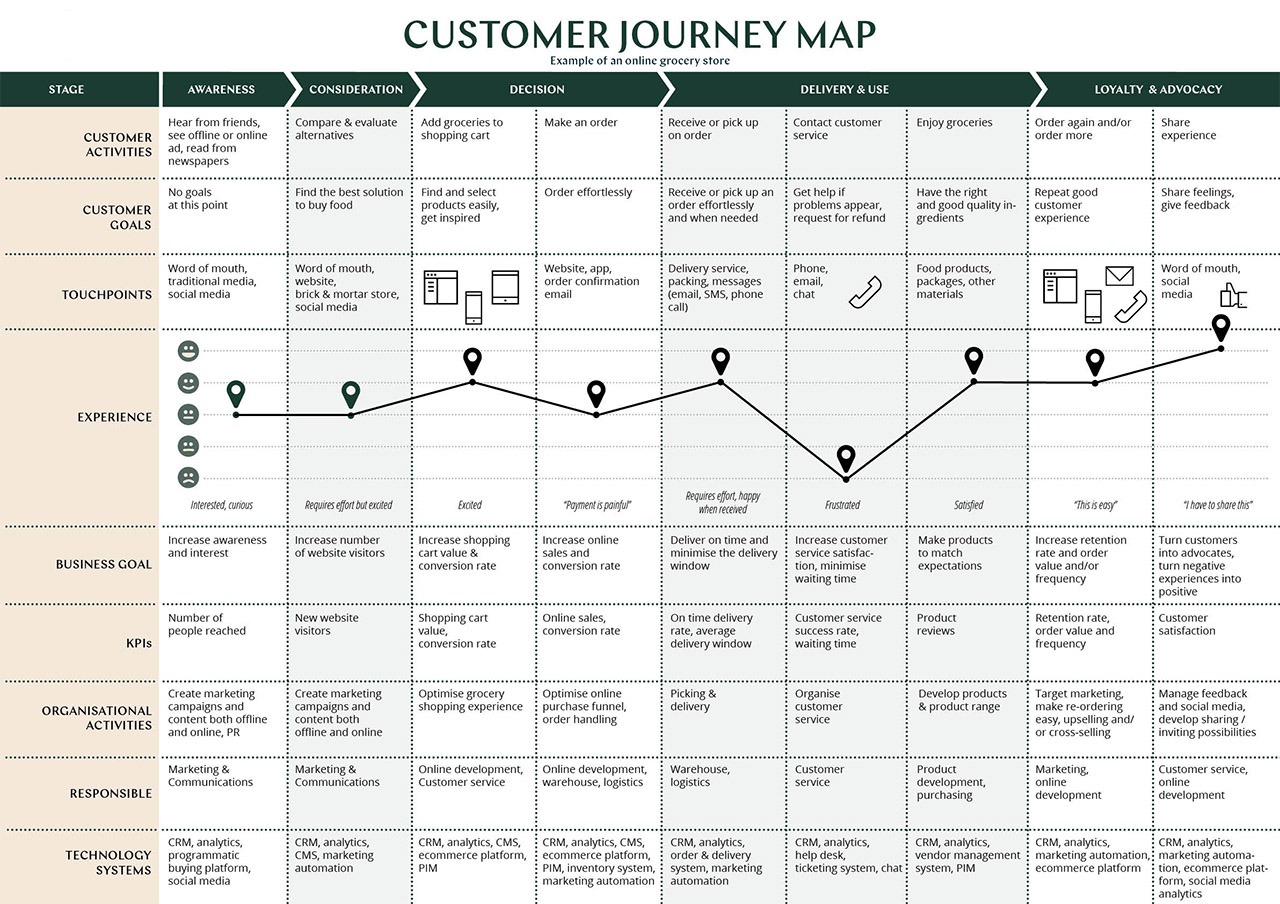

A customer journey map for financial advisers is a visual representation of the journey and actions that a good-fit client makes in order to go from complete stranger to paying client. It will cover every action, stage and interaction with you over the timeline it takes for someone to become a new client with you. By the time it has been created and filled out, you should be able to identify any bottlenecks your sales funnel has, as well as a deeper understanding of what motivates them to work with you.

Why Is A Customer Journey Map Important?

Customer journey mapping allows you to visualise how customers interact with your business. It shows the steps they take to reach a goal. Customer journey mapping highlights key events, customer motivations and areas of friction in their experience. This information is then combined into a visual that depicts a customer’s typical experience working with your company.

Customer journey mapping allows you to visualise how customers interact with your business. It shows the steps they take to reach a goal. Customer journey mapping highlights key events, customer motivations and areas of friction in their experience. This information is then combined into a visual that depicts a customer’s typical experience working with your company.

Understanding this relationship will help you structure your touchpoints in a way that is most efficient and effective for your customers. The customer journey map shows customers the entire process from their first contact to the last touchpoint. This allows them to determine if they are on track to reaching their goals, and if so, what they should do to improve.

Because customers often travel back-and-forth, cyclically, and through multiple channels, the customer journey cannot be represented as a straight line. It is difficult to visualize the customer journey map accurately due to this.

Business leaders who are savvy use many different methods to depict the journey. These include post-it notes, Excel Spreadsheets, and infographics. It is important that the map makes sense for those who will be using it.

Before you begin to create your customer journey map you will need data from customers and prospects. It is a complex but worthwhile process to create a customer journey map.

The Stages Of Your Customers Journey

Before you can create a customer journey map, you need to understand the stages at which people go through in order to make a decision. In our experience, a customer journey map for financial advisers is very much the same as those in any other service based business.

Before you can create a customer journey map, you need to understand the stages at which people go through in order to make a decision. In our experience, a customer journey map for financial advisers is very much the same as those in any other service based business.

You’ll typically find that there are three key stages that your prospects will go through, however, this will be broken down further again, depending on the things that they need to see. To make it truly comprehensive you’ll want to understand how they think and feel at each stage of their journey. Eventually you’ll have a complete visual representation of their experience, emotions and feelings at every stage, allowing you to zero in on the key elements required to convert them from a lead to a client.

So, what are the stages that you need to think about? They are; Awareness, consideration and decision. Now, there may be far more to each stage and many more steps involved than three, but the general idea is that there are things they need to see and experience at each one in order to make the sale.

What Should You Include in A Customer Journey Map For Financial Advisers?

This is where things get a little bit more detailed. When building a customer journey map for financial advisers, you have to think about the emotional elements of your customer. As you may well be aware, people don’t buy on logic. They buy on emotion. Since we are dealing with a highly emotive subject (money and family) you need to take care to include how they feel about things at every stage.

You can add more than these elements if you so desire, however, here is a great place to start when it comes to adding in these key points.

- The buying process

- The actions they take

- What they are interacting with

- Their emotional state at each stage

- Their pain points

- Your solutions

You may also want to give an experience rating at each stage of the journey, for example, after your prospect has had a meeting with you, you would naturally expect them to be feeling on cloud 9, that they have made a very smart decision and would give a 5 star rating to that part of the journey. If you don’t feel they are feeling this way, then you need to look at why this is and what you can do to bring that experience up.

Below is an example of a complex and in-depth customer journey map. You can see how each stage of the journey is broken down and a clear picture is built up of how they interact with the business. You can download your own template here and start filling it out.

Emotional States

You may be wondering why you would need to add in the emotional state of a prospect when creating a customer journey map for financial advisers. Despite the fact we are talking about money, which in most people’s minds is a logical thing, every decision we make is an emotional one. If our emotional state is not high enough, then we won’t feel as though it is an essential decision for us to make. For example, someone speaking to you about retirement planning may not understand the need for it in a financial sense as it may be many years away. They may not fully understand the concept of having a finite pot of money to live off, or even that they can continue to make money from investments in retirement. However, if you can convey to them that they could play a larger role in their grandchildren’s lives and be more present than perhaps their grandparents were, or even more present as parents, then this emotional trigger may speak to them more than simply having money in the bank.

Benefits Of Customer Journey Map

It may seem like that creating this document is just an additional bit of marketing red tape. After all, you’ve closed prospects in the past doing exactly what you’ve done before and you didn’t have a complete understanding over every little detail and step they took; so why would you start now?

Here are a few really good reasons why you want to be looking into this, even if you create it once and then review it again in a years’ time.

Empathise with your clients

Empathising with your prospects will help you to truly understand why they are reaching out to you and what you can really help them with. One of the key pieces of business thought we’ve ever come across is this; most people don’t want to go from rags to riches, they simply want to go from rags to better rags. This means they aren’t interested in billionaire level wealth and status. They simply want to not have to worry about money and focus on the things that are important to them in life. If you can get to the root of their personal issues and understand what motivates them, you’ll be able to speak to them about how your solution will help them achieve that.

Make The Journey Predictable

If you can make a prospects journey uniform then you can start to predict many things in life, including your AUM, MRR and other monetary metrics. You’ll be able to close more business in a shorter time without the guesswork of what will work when converting a prospect. When you can predict revenue, you can start to do much more with your time. You can plan more activities, you can think much further ahead and become in complete control of where you want your business to go.

Stop Prospects From Falling Out Of Your Pipeline

When you have created a customer journey map for financial advisers, you start to get a visual representation of where your leads stall and drop off. Identifying these points in your sales pipeline will mean you can do something about it! Looking at your customer journey map and seeing that it is a 1-star experience, rather than a 4 or 5, will indicate to you that something is wrong and you need to do something about it. A great way to fix it would simply be to ask a prospect why they didn’t convert at that stage. Their feedback will allow you to immediately resolve this issue and plug the gap in future.

Learn If You Need More Resources

You might have found out that people drop out of your pipeline at certain stages. It may well be because they need to see something at that point that you just don’t have. It may be a case study or a testimonial. Whatever it is, you now are armed with the knowledge that your prospect needs to see something more to heighten that emotional state that will reconfirm to them that they need to entrust their money with you.

Final Thoughts

Creating a customer journey map for financial advisers is a big ask. It requires lots of research and careful investigation of how your prospects think and feel, as well as how they interact with you and your business at every stage of their journey. They’re incredibly powerful tools that shouldn’t be ignored as they can provide you with some very revealing insights. They can potentially shed some light on a critical element of your business and workflow that could mean all the difference for you.

One final caveat though before you dive headlong into creating your customer journey map. One size does not fit all. You will have to create multiple customer journey maps for each and every service and product that you have on offer. All clients are different, so you cannot simply map one on to the other.

If you’d like to speak to one of the Adviser Leads team and see how we can help you create your own customer journey map, then click the link below to apply for a strategy session worth $1000.

[…] If you now look at things from the point of view that most of our audience is sat in the ‘don’t think they’re interested’ bracket, then you’ll realise that what they need is more information to help move them along to the next stage in their customer journey. […]

[…] an adviser in the past. From here you will be able to understand a bit more about their challenges, explain who you work with and how you overcame similar challenges of a client in the past. Again, if someone has filled out a […]