- March 19, 2022

- Posted by: Adviser Leads

- Categories: Lead Generation, Marketing Tools

What is a marketing funnel and more to the point what is a marketing funnel for financial advisers? Most people who work in any sort of professional environment will be at least aware of such terminology as funnels or pipelines. They may seem pretty obvious and indeed they are once you know what you’re doing with them. There are, however, a lot of moving parts and planning that goes into creating a marketing funnel for financial advisers.

What is a marketing funnel and more to the point what is a marketing funnel for financial advisers? Most people who work in any sort of professional environment will be at least aware of such terminology as funnels or pipelines. They may seem pretty obvious and indeed they are once you know what you’re doing with them. There are, however, a lot of moving parts and planning that goes into creating a marketing funnel for financial advisers.

A marketing funnel is actually the term for the result of marketing efforts. In an ideal world it wouldn’t be a funnel as the same number of people who enter the top would end up being clients at the bottom. A more realistic description would be a pipeline, but this is not the way the world works. In most marketing terminology the marketing funnel is the process and steps put in place to take a prospect from a complete stranger to a client. It will cover the stages from awareness all the way to decision in one straight line.

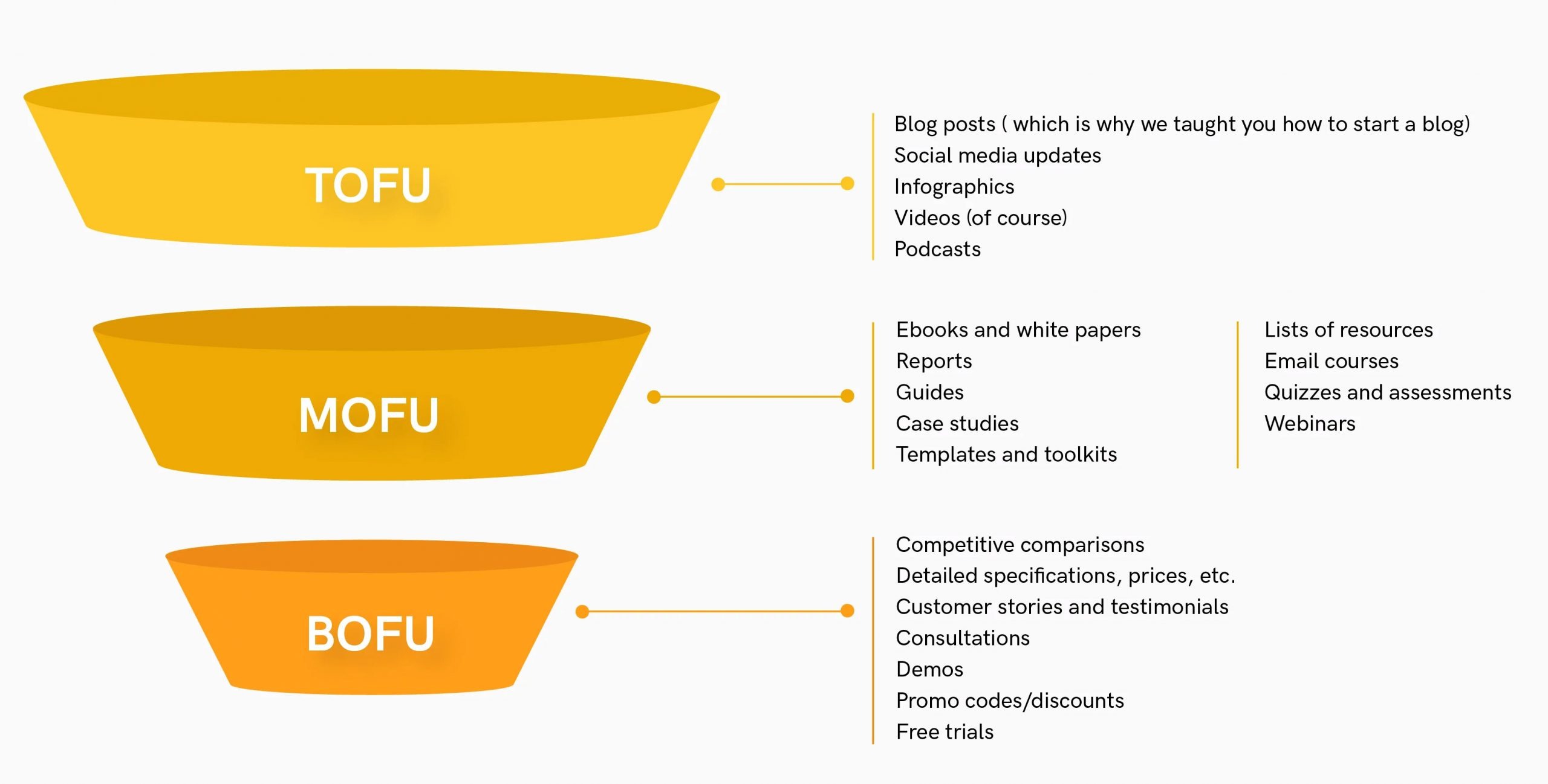

For those not aware of what a marketing funnel looks like, it is typically broken down into 3 stages; top, middle and bottom. Each stage will have particular types of content in use at the different stages that helps to push prospects on to the next stage. In this article we’re going to look at how we can build a marketing funnel for financial advisers and get you generating leads on autopilot.

How have marketing funnels evolved?

Like most things, marketing funnels have become more streamlined. When inbound marketing first started to make an appearance in the world of digital marketing, it was recognised that your website would be a portal to all types of content, which in turn would help prospects to find the right thing for them to convert to the next stage with. As a result, lots of types of content were created to fit those particular needs. Blogs, articles, ebooks, infographics, these sorts of things would be produced at high volume to fit the top of the funnel, or TOFU, need. The process was recreated for the middle section, MOFU and consultation pages and other end point conversion pages were created for the bottom, BOFU.

Now, the issue with this, is whilst a marketing funnel was in place, it was largely unwieldy and difficult to track a specific journey that a prospect might take in order to become a client. It was a very wide approach to funnelling all the traffic that came to a website. So, how does this impact a marketing funnel for financial advisers? Well, the next stage in the evolution of the marketing funnel means that they actually become more focused.

Over time, marketers started to realise that by niching down their offering, understanding exactly who they were targeting and focusing on specific problems they were trying to help prospects to solve, that their marketing funnels could become more streamline; meaning they only needed a few specific, but very high quality pieces of content.

The Objective Of A Marketing Funnel For Financial Advisers

The main objective of a marketing funnel for financial advisers is to generate high quality leads who are ready to work with you. Frankly, that’s a given. There wouldn’t really be much point in investing all that time and effort into building a marketing funnel if you weren’t generating anything from it. There are, however, a few additional objectives that be aimed for when building a marketing funnel for financial advisers.

Increase Trust

Financial advisers have a bit of a bad rep. That and the fact that most people want to do their own research before speaking to anyone means that trust plays a really high role in the entire sales process. People want to trust the person who is managing their money at the end of the day. By creating a valuable piece of content that helps to inform someone before they even speak to you, frames you as a trustworthy source of information long before the ever speak to you.

Establish Authority

There are plenty of financial advisers out there, but very few portray themselves as an authority. Through building a marketing funnel and knowing what each prospect needs to see at each stage, you are positioning yourself as the authority on that particular subject. This is of course an extension of the trust factor. If the entire journey, understanding of their needs and problem is solved through the marketing funnel you create, then you will quickly become the authority on that subject matter,

Drive More Relevant Traffic

A really great way to build a marketing funnel for financial advisers is to start with something called pillar content. What this is, is a statement or all encompassing guide to a particular subject. Moz has a brilliant guide to SEO that covers literally every aspect you could hope to know about getting started with SEO. Google loves content, more specifically, content that is really useful and informative. This in turn makes Google realise that the information you are giving is potentially very valuable to others who are searching for this type of thing and will place your page (and subsequently top of funnel item) at the top of the SERPs. Who doesn’t love free traffic?

Decrease Costs From Free Traffic

How much is it currently costing you to generate a lead? If you don’t know, it’s time we talked… What is the ROI on your current marketing spend? Would you like it to be less? Well good news, marketing funnels for financial advisers are actually pretty cost effective. The reason behind this is that you are focusing on your ideal prospect, driving them towards a single conversion point and solving a key challenge that they have. If you are using a high-quality piece of content then it is likely that you will be getting plenty of organic traffic to the site, organic means free. Organic typically converts much higher than any other type of traffic, so by building a funnel, you’ll be reducing the amount of money you spend to acquire those new leads.

Nurture Prospects On Autopilot

It’s highly unlikely that you have the time needed to call all of the leads your new marketing funnel is generating, and frankly, even though they are raising their hand and telling you that they are interested in your top level content that in no way means they are ready for a sales call. Most people will still be in research mode and not ready to be talking to someone. A portion of those people will never be interested in working with you, so will simply read the content and never come back.

The great part about marketing funnels for financial advisers is that they can be completely automated. Once someone has filled out a form and given you their contact details, it is entirely possible to have every interaction with them, until they book in a call with you, to be completely automated. You can even change and edit the content they see based on their reaction to the automation. Pretty cool right? This means you spend even less time chasing prospects who aren’t ready and more time having meaningful meetings leading to more business.

Benefits Of A Marketing Funnel

The number one benefit of a marketing funnel for financial advisers is that once set up, it will automatically deliver leads to your inbox. If set up correctly they will filter leads out for you and you will only ever get to speak with those that are ready to start working with you. There are of course other benefits that setting up a marketing funnel has for advisers.

The number one benefit of a marketing funnel for financial advisers is that once set up, it will automatically deliver leads to your inbox. If set up correctly they will filter leads out for you and you will only ever get to speak with those that are ready to start working with you. There are of course other benefits that setting up a marketing funnel has for advisers.

Instead of constantly creating content for the top of the funnel, a more focused approach can be taken to talking about the specific challenge that that particular funnel is helping to solve. In this way you are simply adding depth and breadth to the top of the funnel, reinforcing the objectives of your marketing funnel. It also allows you to then build out a second funnel that will focus on another subject area. In this way you are able to build out multiple lead generation funnels that focus on the different areas of your business.

The last benefit of building a marketing funnel for financial advisers? They’re super quick and easy to replicate. All you need to do is fill in the gaps in terms of content and your new funnel will be ready to go.

What Tools Do You Need To Build A Marketing Funnel For Financial Advisers?

It really does depend what type of funnel you want to build. If you want to create a webinar funnel, then you will need additional platforms and tools. However if you want to create a simple lead generation funnel then fewer things are needed.

Whatever funnel you want to build, you are going to need to have at least one landing page. This can be built on your website or with one of the many landing page building tools that are out there.

An email client is also an essential tool. We don’t mean your regular gmail client, but something like Mailchimp, Constant Contact or Aweber. Something that will allow you to send automatic emails based on time, what form they have filled out and what actions they may have taken on site.

The key tool that you are going to need is, of course, the lead magnet. What is the thing that people are going to be handing over their contact information for? It could be a guide, an article, an infographic. It has to have value and it has to help solve a problem. The intricacies of marketing funnels for advisers depends upon the particular campaign you are running and what you want to achieve from it. So this is not an exhaustive list of tools needed.

There are many different marketing funnel options that can help you to drive new qualified leads to you. However, they do require a bit of thought to begin but once set up you can largely forget about them. They will need to be monitored and tweaked according to the data that you get back from your analytics, but once you know what you are looking at, you can make changes and focus more on growing your business.

If you want to learn more about building a marketing funnel for financial advisers, then reach out to us and book a strategy session so that our team can help you to put a marketing funnel in place for your business.