- September 27, 2022

- Posted by: Adviser Leads

- Categories: Business Growth, Innovation, Marketing Information

Social media is an unavoidable aspect of our daily lives and many people are now turning to instagram and tik tok for financial advice. Whilst this may seem like a radically risky thing to do, there is a genuine shift in where people are going to get their information. The internet changed the sales process many years ago when people were able to find out any information they wanted about any product or service long before they spoke to a sales rep. As information has become more and more accessible, people have become less and less trusting of everything they see. It’s pretty clear that Gen Z don’t want to use Facebook and with many recent high profile cases of political interference through advertising it’s understandable that they are not particularly trusting of the more mainstream sources of information.

We’re going to look at why people are turning to instagram and tik tok for financial advice and if this is something that you need to be looking at to grow your AUM.

Why People Are Turning To Instagram And Tik Tok For Financial Advice

A total of 18.6 million UK adults, especially those between the ages of 18 and 24 are influenced by financial advice offered on social media platforms such as TikTok, Instagram and Facebook. This is just when TikTok announced it will stop financial services advertised via the platform, in order to reduce the spread of harmful advice and false information on the internet. Why is this happening though? Why are people looking towards social media platforms for information on their finances?

A total of 18.6 million UK adults, especially those between the ages of 18 and 24 are influenced by financial advice offered on social media platforms such as TikTok, Instagram and Facebook. This is just when TikTok announced it will stop financial services advertised via the platform, in order to reduce the spread of harmful advice and false information on the internet. Why is this happening though? Why are people looking towards social media platforms for information on their finances?

Well, if you look at the people who are giving out this advice, they typically tend to be younger people who look and sound like the people who are seeking it out. The advice is given out in short snippets of easy to understand info that is often focused around knowing laws and rules that you may not otherwise know as well as great ways to get benefits and bonuses from credit cards or other loan methods.

Gen Z and millennials have seen the fallout of people playing fast and loose with other people’s money and so are not willing to trust the established institutions.

Gen Z And Millennials Are More Finance Aware

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/68684137/GettyImages_1264127483.0.jpg) This is not quite a correct statement. What we mean here is that they are more likely to pay attention to and recognise that their finances need attention. It doesn’t mean that they are better with money. There is still a huge lack of financial education for many people but they are at least trying to understand more about how investing works, as well as ways in which they can utilise financial tools (credit cards, loans etc…) in order to grow their own wealth and secure their future, rather than being stuck in debt traps. Turning to channels like Tik Tok for financial advice seems like a logical and risk free way for people to learn more about a subject that has been notoriously murky and difficult to understand in the past.

This is not quite a correct statement. What we mean here is that they are more likely to pay attention to and recognise that their finances need attention. It doesn’t mean that they are better with money. There is still a huge lack of financial education for many people but they are at least trying to understand more about how investing works, as well as ways in which they can utilise financial tools (credit cards, loans etc…) in order to grow their own wealth and secure their future, rather than being stuck in debt traps. Turning to channels like Tik Tok for financial advice seems like a logical and risk free way for people to learn more about a subject that has been notoriously murky and difficult to understand in the past.

Gen Z and Millennials are incredibly conscious of the cost of living crisis and day to day expenses. They have witnessed their parents and grandparents generations sinking themselves into debt in order to be seen to be living the dream and conforming to what society dictates to them should be doing. Get a bigger house, buy a nicer car, have all of the mod-cons at home. Keeping up with the Joneses is a way of life many want to avoid, but knowing where to put your money instead is the crux of the matter. Many Gen Z and Millennials may have some more spare cash, know that it is not worth keeping in savings but don’t know what to do with it beyond that. When the place you spend your time online starts giving you info on what you can and should be doing with your money, all of a sudden you can see how it would make sense to turn to Instagram and Tik Tok for financial advice.

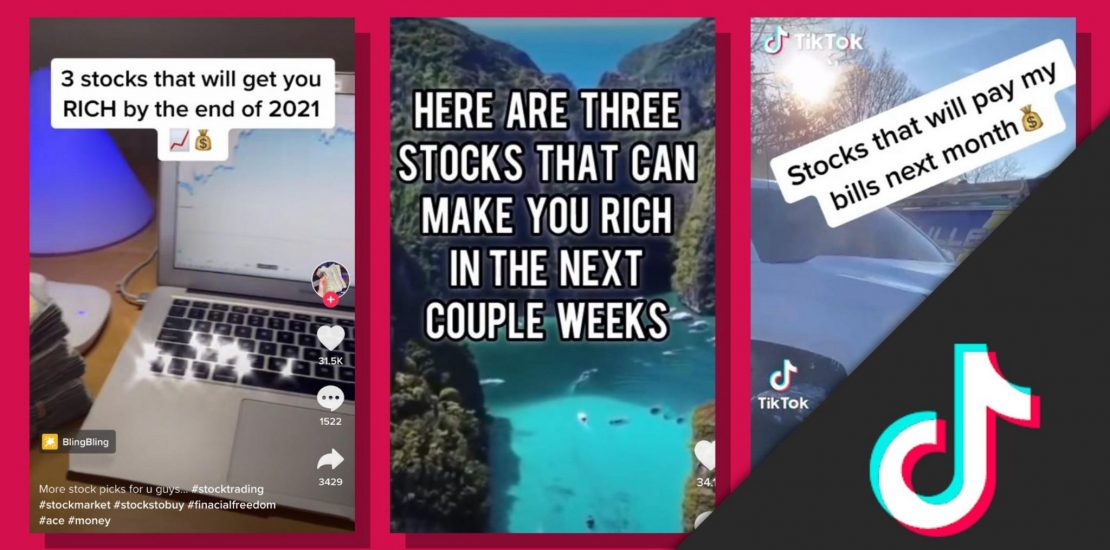

The Dangers Of Trusting Instagram And Tik Tok For Financial Advice

To be honest, this shouldn’t really need much explaining. The old adage of never believe anything that you read and only half of what you see rings true here. Who are these people online giving our financial advice on Tik Tok and other social platforms? What credentials do they have? Are they actually financial advisers or people who simply worked it out for themselves and managed to make money in a particular fashion? What if the advice they give out is not relevant for the country you live in?

To be honest, this shouldn’t really need much explaining. The old adage of never believe anything that you read and only half of what you see rings true here. Who are these people online giving our financial advice on Tik Tok and other social platforms? What credentials do they have? Are they actually financial advisers or people who simply worked it out for themselves and managed to make money in a particular fashion? What if the advice they give out is not relevant for the country you live in?

Blindly trusting people on Instagram and Tik Tok for financial advice is a disaster waiting to happen for many people. It could be that some of the info given out could now no longer be relevant or outdated meaning people may make the wrong move with their money. As an adviser, we really don’t need to be telling you about this, however, as you start to earn more and more new Millennial clients, you will likely have conversations with people who have conflicting opinions on money issues.

How Can You Impact Social Media Financial Advice?

If ever there was a time that you need to be utilising social media channels, it’s now. That doesn’t mean that you need to become and Instagram or Tik Tok influencer, it simply means that you need to know what is happening on those channels. Of course, it never hurts to have a solid social media plan. You are likely to find many people searching for answers and if you’re giving them, it is likely that you will get more people asking you to help them achieve their financial goals.

Take time to understand what people are looking for when searching Tik Tok for financial advice. Many of these people will cover a wide range of topics but often don’t give much insight or depth when it comes to explaining complex issues. This can be your go to bank of ideas that will tell you what people are searching for online. If you do decide to start your own channel, you could do some explainer videos or even some longer form discussions of hot topics within the world of finance.

In Summary

The way people are searching for information is changing. Search engines still dominate, but they are also now including social media channels as search results. The new generation of wealth management clients look to different channels for the news and education. This doesn’t mean that traditional platforms are no longer valid, it simply means that as a financial adviser, you need to be aware of what is happening on what, as well as what you can do to take advantage of it.

To learn more about how Adviser Leads can help you to maximise social media channels, book a session with us today.

[…] you start throwing money around and trying out all the latest social media platforms, and spending money on paid ads, it’s a great idea to think about what channels you are going to […]